Advice for international companies established in Burkina Faso

Accounting expertise

Accounting expertise plays an essential role in the financial and accounting management of companies.

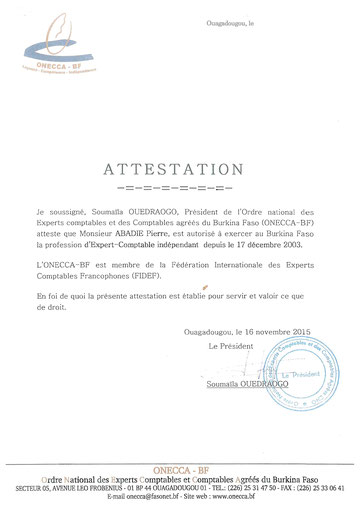

Pierre ABADIE

Chartered Accountant

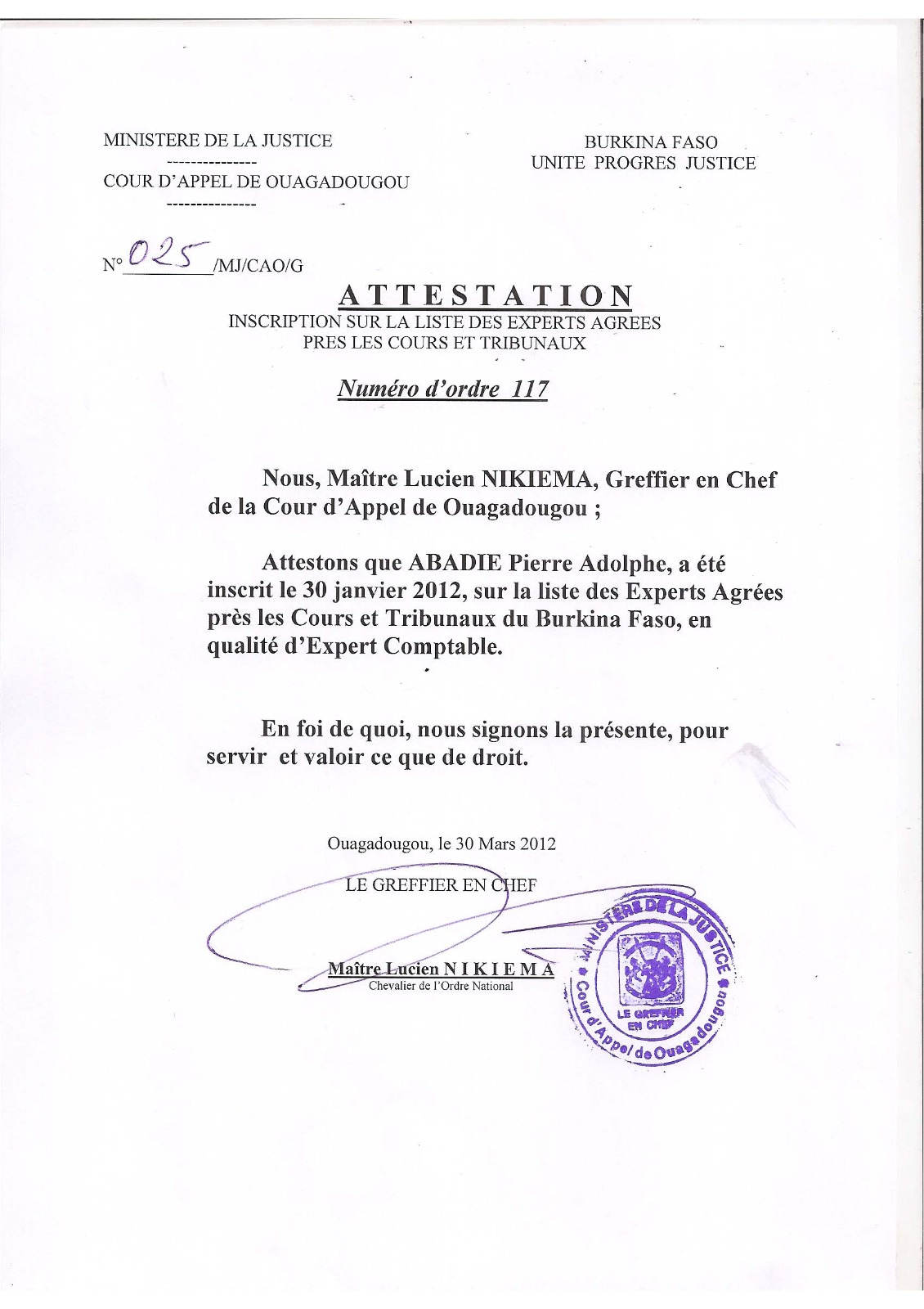

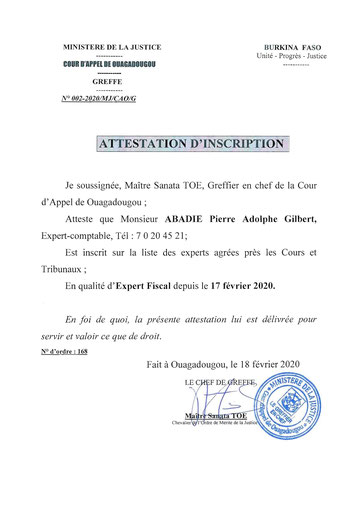

Pierre ABADIE is a legal expert in accounting from Burkina Faso.

Having qualified as a chartered accountant at the age of 27, Pierre ABADIE was one of the youngest chartered accountants in France. He and his Burkinabè team have been working in Ouagadougou since 1998.

Chartered accountancy

Chartered accountants play an essential role in the financial and accounting management of companies. Whether you’re a small business, a not-for-profit corporation or a large enterprise, public accounting is crucial to maintaining good financial health and making informed decisions.

Our qualified team of chartered accountants has solid expertise in various areas of accounting and finance. We’re here to help you manage your finances, optimize profitability, maintain tax compliance and make strategic financial decisions.

We understand that every company has specific needs, which is why we offer customized services tailored to your situation. Whether you need regular bookkeeping assistance, expertise on a specific issue or an in-depth financial assessment, our team of chartered accountants is ready to meet your needs.

Our firm

Cabinet Pierre Abadie offers accounting review and auditing services.

Pierre ABADIE, who qualified as a chartered accountant in France in 1983, has been a member of the Burkina Faso Order of Chartered Accountants(www.onecca.bf) since 1994.

Accounting and auditing is the firm’s core business, before developing its legal advisory activities.

Companies monitored

Several areas of intervention

Bookkeeping and general accounting

The chartered accountant can manage and maintain the company’s accounting books, recording financial transactions, drawing up financial statements and producing accounting reports.

Tax and social security returns

The chartered accountant can prepare and file periodic tax returns, such as VAT returns, corporate income tax returns, payroll tax returns, and so on.

Audit and certification

The chartered accountant can carry out financial audits to verify the conformity of a company’s financial statements and guarantee their reliability. Audits can also help identify financial risks and opportunities for improvement.

Financial advice

The chartered accountant can provide financial advice and analysis to help companies make informed decisions on investment, budget planning, cash management and financing.

Financial analysis

The chartered accountant can carry out in-depth financial analyses, including assessing financial performance, analyzing financial ratios, interpreting accounting data and preparing management reports.

Management consulting

The chartered accountant can provide management advice, particularly on organizational structuring, risk management, internal control and compliance with accounting and regulatory standards.

International correspondents

Our costumers

Let us know your concern

Without engagement

We understand that every tax situation is unique, which is why we offer you the opportunity to request a personalized quote. Whether you’re a business or an individual, our team of expert tax advisors is here to help you with your specific needs.