Advice for international companies established in Burkina Faso

Tax advice

All of Burkina Faso’s taxation, analyzed and explained by experts to provide you with the best advice for your business.

Cabinet Pierre Abadie

Tax advice in Burkina Faso

and international

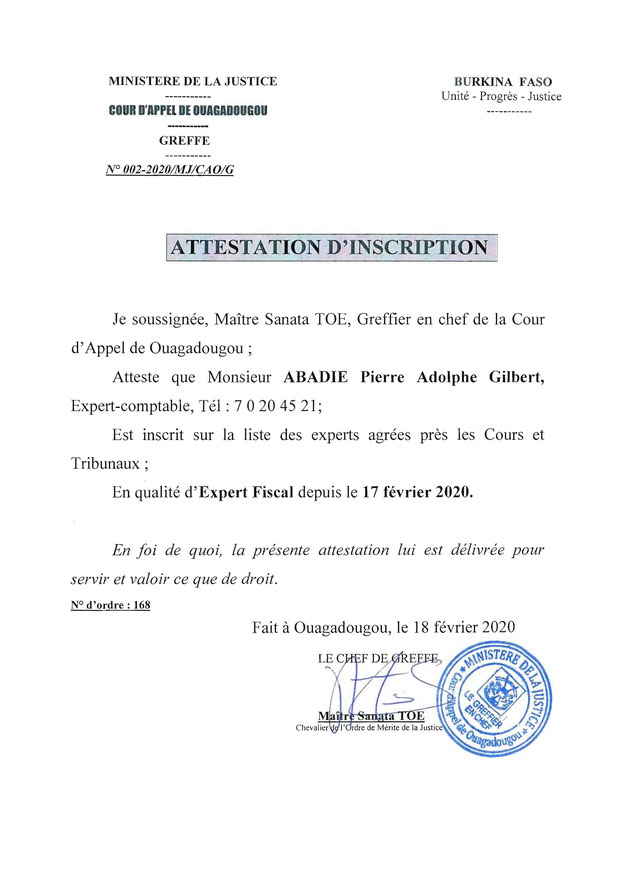

Pierre ABADIE is tax advisor to Burkina Faso companies and their parent companies. He is a legal expert in tax matters

Tax consultancy plays a crucial role in managing tax issues both in Burkina Faso and internationally. When it comes to navigating complex tax regulations, it’s essential to call on experts to ensure compliance and optimize your tax obligations.

Burkina Faso’s tax system is based on specific regulations affecting individuals and companies. Income, sales, corporate and other taxes are an integral part of the tax landscape. Understanding these regulations is essential to avoid legal and financial problems. Failure to comply with tax laws can result in penalties, fines and other adverse consequences.

However, tax consultancy is not limited to Burkina Faso. In an increasingly interconnected world, companies and individuals can be faced with complex international tax regulations. Bilateral tax treaties, price transfer rules and preferential tax regimes can have a significant impact on tax planning and compliance for those operating across borders.

Our firm

Tax consultancy plays a crucial role in legal tax optimization. By using deductions, tax incentives and appropriate business structures, it is possible to legally reduce the tax burden. However, it is important to stress that illegal tax avoidance or tax evasion should not be considered as options. Tax compliance and transparency are key to maintaining fiscal integrity.

With us, you’ll find essential information on Burkinabe tax regulations, international tax regulations, legal tax optimization strategies, tax reporting obligations and much more. Our goal is to provide you with valuable resources to help you better understand tax issues and make informed decisions for your specific situation.

Don’t forget that tax regulations can change over time, so it’s important to consult reliable sources on a regular basis, and to call on expert tax advisors for personalized, up-to-date advice. Explore the various sections of this reference page to gain in-depth knowledge of Burkina Faso and international tax consultancy.

This document compiles all the tax texts of Burkina Faso, including the General Tax Code 2022, the Mining Code in its tax part, the Investment Code and its implementing texts, International Conventions (France Tunisia and UEMOA), as well as all other regulatory provisions related to taxation. A table of contents and an index are provided to facilitate searches. The Pierre Abadie Cabinet, an accounting and legal consulting firm, publishes materials related to taxation, customs, social matters, mining, and more for Burkina Faso.

In Burkina Faso, foreigners are perceived as distinguished individuals to be welcomed and respected even more than anyone else. A foreign businessperson can invest in the country without constraints. additional. In Burkina Faso, there is no need for a prior visa. Foreign businesspersons can make their visa application upon arrival at the airport. They can hold executive positions in companies, own 100% of the capital of their company, purchase assets, and more.

Convinced that providing information to businesses is one of the fundamental elements of development, Cabinet Pierre ABADIE, alongside its consultancy activities, publishes around twenty books in French and English (see www.cabinetpierreabadie.com).

The present Labor Regulations of Burkina Faso are in line with the same logic, as many social conflicts arise not from the bad faith of the parties but more often from a lack of knowledge of the laws and regulations.

Let us know your concern

Without engagement

We understand that every tax situation is unique, which is why we offer you the opportunity to request a personalized quote. Whether you’re a business or an individual, our team of expert tax advisors is here to help you with your specific needs.