Advice for international companies established in Burkina Faso

Our publications

Sharing with you the highlights of our firm that have been captured and immortalized by the national and international press.

In Burkina Faso, the following VAT rates apply:

- Standard rate: 18%

- Reduced rate: 10%

- Other: exemptions and zero-rated exemptions with credit.

The main legislation in Burkina Faso regarding VAT is Law No. 058-2017 of December 20, 2017, known as the General Tax Code of Burkina Faso (the “Tax Code”), as amended. VAT is covered in Book II, Title I, Articles 296 and following of the Tax Code.

Please refer to Annex 15.2 for a link to the legislation.

The General Tax Directorate (the “Tax Authority”) is responsible for the administrative control of VAT in Burkina Faso.

The Customs Administration of Burkina Faso (the “Customs Authority”) is responsible for the collection of VAT due on imports.

BLOOMBERG: Tax Guide of Burkina Faso

Burkina Faso is a democratic republic with a separation of powers between the executive branch led by the President, the unicameral legislature, and the judiciary.

Laws must be passed by the unicameral legislative body (National Assembly) and promulgated by the President. They become laws upon their publication in the Official Gazette.

It is specified that for the implementation of its programs, the government may request from Parliament the authorization to take, by ordinance, measures that normally fall within the realm of the law.

Taxation is mainly governed by Law 58-17/AN of 27/12/2017 on the General Tax Code and subsequent finance laws.

The jurisprudence of the relevant administrative jurisdictions contributes to legislative developments in tax matters, through the Finance Acts. Furthermore, theoretically, the Constitutional Council can declare a tax provision unconstitutional, which would render that provision inoperative.

The tax system is administered by the Direction Générale des Impôts (DGI). It is responsible for the development and implementation of national tax legislation.

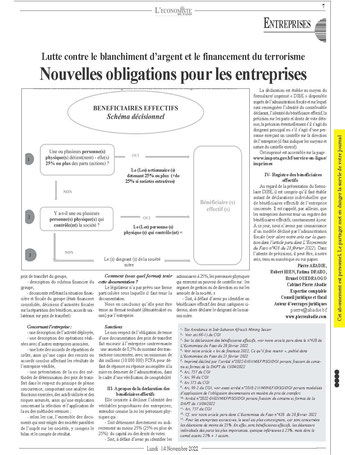

COMBATING MONEY LAUNDERING AND THE FINANCING OF TERRORISM

A boon for the country’s tax revenues and security.

At a time when the Financial Action Task Force (FATF), the guarantor of compliance with international norms and standards in the fight against money laundering and the financing of terrorism (AML/CFT), has placed Burkina Faso on the list of jurisdictions “under enhanced scrutiny”, commonly known as the “grey” list, and in the security context we are experiencing, which is generating new financing needs, the fight for transparency is being stepped up, and the tax authorities are mobilizing and mobilizing companies.It is to be feared that Burkinabè companies, whether parents or daughters, will fall victim to substantial tax reassessments in the coming months and years. To protect themselves, they must pay particular attention to the formalization of their file (documentation, transfer pricing declaration, declaration of beneficial owners, register of beneficial owners). After a possibly painful period of compliance, we will undoubtedly see improved management of groups of companies, which will apply rates more in line with economic realities and less for the sake of tax optimization. Considering that parent companies tend to want to declare their profits at head office, and that most of the time we’re dealing with Burkinabè daughters, since the parent companies are foreign, the introduction of the anti-money laundering and anti-terrorist financing system should benefit Burkina Faso’s tax revenues and security.

Mining companies and their subcontractors are now obliged to buy from Burkinabe suppliers.

Nevertheless, for certain goods and services, it will be possible to use foreign suppliers to a limited extent.

The spirit of the text seems to be that the owners of these suppliers should be Burkinabè, holding at least 51% of the companies’ capital.

However, the letter of the text seems to allow foreign companies to structure their shareholding to avoid this requirement.

Because of the timetable for implementing these provisions, the purchases concerned are those made on or after January 1, 2023.

A clarification and review of the text could take place well before this deadline, which is fateful for some.

New bonds :

- Present a tax status certificate (ASF) for customs clearance.

- For companies to declare the natural persons holding power or ownership of the companies (the “beneficial owners”) and to keep a register of these beneficial owners.

- production of documentation to justify the pricing policy between affiliated companies for companies with sales or gross assets of over FCFA 1 billion, compared with FCFA 3 billion previously.

- annual transfer pricing declaration no later than May 31 for the year ended December 31 of the previous year.

- Introduction of a new tax procedure against tax evaders: flagrance fiscale

The basis for calculating the property tax (tax on real estate assets) will be determined according to a scale to be published by the French administration.

Possibility of splitting the payment of registration duties on long leases (leases with a term of more than 18 years) and clarification of the method for determining the actual rental value. Renewal of the flat-rate registration fee for transfers (sales, inheritances, etc.) of residential property.

Companies in Burkina Faso are now required to declare their beneficial owners and keep a register of them.

The beneficial owner of a company is the natural person or persons who :

- directly or indirectly hold more than 25% of the company’s capital or voting rights,

- exercise control over :

- management or executive bodies

- or on the company’s partners

The declaration of beneficial owners must be made when filing the next corporate income tax return, i.e. by April 30, 2022 at the latest (penalty: fine of FCFA 500,000).

An obligation to keep a register of beneficial owners has been introduced. Applicable from 01/01/2022 (penalty: fine of 2,000,000 FCFA).

Burkina Faso’s Finance Act 2022 introduced a procedure known as “flagrance fiscale”.

This new procedure in Burkina Faso’s tax system is designed to crack down on tax evasion and illicit activities on the part of taxpayers.

Flagrance fiscale is triggered on the basis of findings made by the tax authorities in the course of :

- a tax audit,

- the exercise of its right of investigation,

- the exercise of his visiting rights.

The facts subject to application of the flagrante fiscale procedure are :

- occult activities

- issuing fictitious invoices,

- deduction of fictitious expenses,

- actions that deprive the accounts of probative value.

This procedure enables the administration to carry out protective seizures and ex officio tax assessments.

In any case, the flagrance procedure may be suspended at the taxpayer’s request, provided that the taxpayer proposes to regularize his tax situation and pay the taxes due in simple law, penalties, fines and default interest. In addition, taxpayers who contest the flagrante delicto procedure against them retain the right to lodge a contentious appeal (administrative then judicial).

The personal wealth tax that some people are calling for already exists in Burkina Faso! It’s called contribution foncière.

The land tax is 1 per thousand or 2 per thousand per year of the value of buildings and plots.

Collection is currently difficult for the DGI, but with the introduction of the tax registry, the amount of these levies will undoubtedly explode.

Some estimates evaluate the potential annual revenue that this tax can generate at several hundred billion CFA francs, equivalent to the amount generated by the Personal Income Tax (IUTS) or Corporate Income Tax, compared to only 1 billion previously!

With the help of drones and geolocation, the net is being tightened, and it’s important to be familiar with this tax, which must be paid by March 30 of each year, on pain of a 25% penalty.

Let’s hope that this financial windfall, which is mainly intended to benefit local communities, can at least curb land speculation and enable us to enjoy significant local and urban infrastructure.